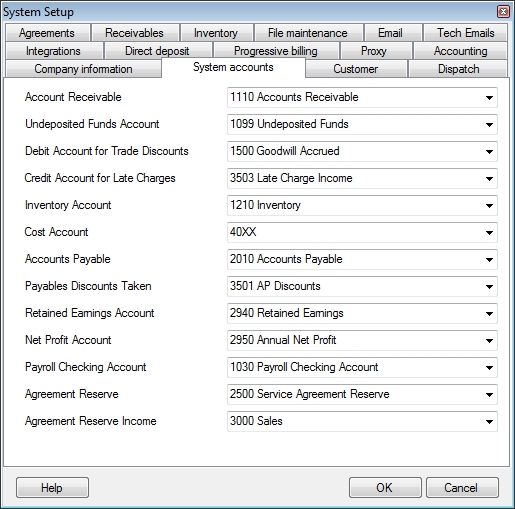

System Accounts

This screen allows you to set default accounts for various transactions. New accounts cannot be created on this screen. If you find you do not have a necessary account already created, please go to the Enter Chart of Accounts screen to add it, then return to this screen and select it.

Important Note: Changing these values will not affect previous transactions.

Accounts Receivable

Enter the Accounts Receivable account here after the Chart of Accounts has been established. This account will keep a running balance of money owed to you by customers.

Undeposited Funds Account

The undeposited funds account acts like a clearing house for incoming payments. Payments are temporarily debited to this account when they are first made. They are then routed to desired account and removed from this list when a deposit is made.

Debit Account for Trade Discounts

This feature has been replaced with the creation of payment methods and is unnecessary for normal use. It remains here for the benefit of customers upgrading from older versions of ESC. It is OK to leave this field blank.

Credit Account for Late Charges

When monthly statements are run in Receivables, late charges are computed on overdue invoices. These late charges are journalized with a debit to Receivables and a credit to the account specified here. This will generally be some kind of other income account.

Note: When using QuickBooks or Peachtree integration, late charges will be created in those packages instead so this field will be ignored.

Inventory Account

This field is used to set the default general ledger account that will be debited for the cost of a part when it is purchased and credited when it is sold. This default can be overridden by changing the inventory account on individual inventory items or by changing the account used when receiving the part.

Cost Account

This field is used to set the default general ledger account to be debited when a part is sold. This account number can still be modified on a per item basis when the part is entered.

Accounts Payable

This field is used to set the Accounts Payable account that will be credited when a bill is created for parts received.

Note: The following fields are only necessary if you are using the ESC Accounting software.

Payables Discounts Taken

Certain vendors may offer discounts off of goods and services purchased from them if paid within a specified time. Use this field to set the account that will be credited when taking advantage of these offers. This will generally be some kind of other income account.

Retained Earnings Account

Use this field to enter your retained earnings account. When closing the books for the year, the net profit account is cleared and added to this account.

Net Profit Account

Enter your net profit account here. This is a balance sheet account that is affected with every transaction made that changes an income or cost of sales account.

Payroll Checking Account

This field is used to select the account that be used when creating payroll checks. It is typically set to an asset account.

Agreement Reserve

Use this field to enter the liability account for service agreement prepayments. Once this revenue is earned it will be transferred to an income account.

Agreement Reserve Income

Use this field to enter the income account that will be credited when previously deferred agreement income is realized.

See also:

System Setup - Company Information

System Setup - File Maintenance

System Setup - Progressive Billing