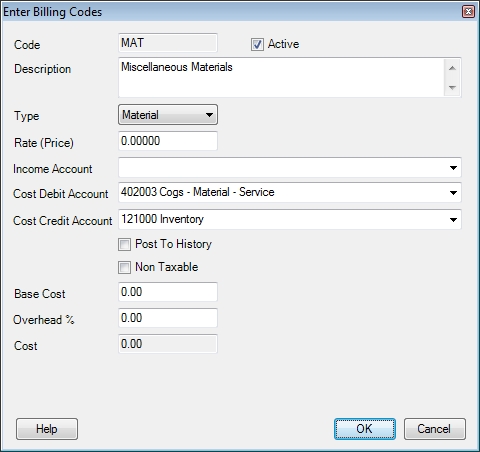

Enter Billing Codes

Use this screen to set

up special Billing Codes, descriptions,

account numbers and amounts. Billing

Codes are used on the Sales Invoicing screen in place of an inventory

part number. Examples

of special Billing Codes are various kinds of labor charges, diagnostic

charges, material charges, and tax. These

codes can be set to debit and credit their own general ledger cost and

sales account numbers that would be different from the normal accounting

flow of a sales invoice.

Click the Add New button to create a billing code or double click an existing one to edit it.

Code

Enter up to a 15-character code here.

Active

Remove the checkmark from this field if you do not want the code to show on search screens or reports. The part can still be used by opting to show inactive parts but it will be extremely difficult to do accidentally.

Description

Enter a

description of this Billing Code as you would like it to appear on invoices.

Example:

DIAG might be entered for a code

to denote a diagnostic charge, and the description "Diagnostic

Charge" would appear on the invoice for the customer to see.

An unlimited

number of characters may be entered for the billing code description.

Type

Click on the down-arrow

button to the right of this field to select a type for this Billing Code:

Labor, Material, Contract, Discount,

Helper, 0ther, Mat Markup, Other Markup, and

Contr Markup. The

type determines the category on the sales reports where the cost and sales

amounts will appear.

- Labor: the

charges for a billing code with a type of Labor

will appear in the Labor Sale

column on Sales Reports. Using

a billing code on a sales invoice with a type of Labor

will calculate the hours entered by the Rate on the Enter

Billing Codes screen. If

the Rate field is blank, the Labor Rate for the location being invoiced is used instead. This allows you to use one labor code to invoice all of your clients regardless of their rate.

- Material: the

charges for a billing code with a type of Material

will appear in the Material Sale

column on Sales Reports.

- Equipment: this type of billing code functions identically to the Material type billing code unless you are using the ESC Accounting module. When integrated with ESC Accounting this type will show up on a separate column on certain job reports.

- Contract: the

charges for a billing code with a type of Contract

will appear in the Contract column

on Sales Reports.

- Discount: using

a billing code on a sales invoice with a type of Discount

will display a prompt that asks for the percentage of discount. That

discount will then be calculated and applied on all line items above the

discount billing code. The

discount percentage that is initially displayed on the discount prompt

is read from the Rate that was

entered on the Enter Billing Codes

screen. If

this is blank, the Discount %

from the Enter Customers screen

for this customer becomes the default. In

both cases, the discount percentage may be changed when the prompt appears

on the Sales Invoicing screen.

- Helper: using

a billing code on a sales invoice with a type of Helper

will calculate the hours entered by the Rate on the Enter

Billing Codes screen. If

the Rate field is blank, the Helper Rate for the location being invoiced is used instead.

- 0ther: the

charges for a billing code with a type of Other

will appear in the Other Sale

column on Sales Reports.

- Mat Markup: using

a billing code with a type of Mat Markup

will display a prompt on the Sales Invoicing screen that asks for a percentage.

If a percentage

has been entered into the Rate

field of this billing code, it will appear as a default on the prompt.

It may

be changed to any percentage. The

material cost of all material line items that appear above this billing

code on the Sales Invoicing screen will be multiplied by this percentage

and entered as the Price and Amount for this line item. The

purpose for this kind of code is primarily for contract bidding. Material

will be listed on an invoice or a quote, and the selling prices for these

items will be zeroed out (this can be done by clicking into any Price

field and editing it to be 0.00. The

zero amount will extend to the Amount

field). With

the selling prices of the individual material line items being zeroed

out, a billing code with a type of Mat

Markup is used to mark up the cost of all material by a certain

percentage. Let’s

say that you are bidding on a job, and that you need to make 20% over

the cost of the material. The

material items will be listed on the invoice first, and then a markup

code with a type of Mat Markup

is used below that to calculate a percentage of the cost of that material

listed above. In

this example, if you wish to make 20% on the job, enter 120 in the Rate field. This

will appear in the prompt on the Sales Invoicing screen when the billing

code is used, and it can be overridden at that point regardless of what

number exists as the Rate on the

billing code.

- Equipment: this type of billing code functions identically to the Mat Markup type billing code except that the markup is only applied to items listed on the invoice as an Equipment type.

- Other Markup: using

a billing code with a type of Other Markup

will calculate the cost of all billing codes with a type of Other

that are listed above on the invoice times the percentage in the Rate field of the billing code. A

prompt will appear on the Sales Invoicing screen when this type of billing

code is used, and the percentage in the Rate

field will appear as the default. It

may be changed to any percentage at that point. Before

using this type of billing code, the billing codes with a type of Other must have a debit and credit account

number in the cost fields of the markup codes themselves. If

account numbers are entered into these two cost fields on the billing

code, the billing code will prompt the user for a cost per unit that will

be totaled in the Other Cost field

on the Sales Invoicing screen. A

markup code with a type of Other Markup

calculates only on the cost of a billing code that has a type of Other, and not the selling price. In

the same scenario as the Mat Markup

code above regarding a bid, the selling prices should be zeroed out on

those line items before using a billing code with a type of Other

Markup. In

this way, the customer will see only one selling price for the entire

bid rather than individual line item selling prices. When

entering a Rate on the Enter

Billing Codes screen, use a number like 120 to calculate a 20%

profit. 100

would calculate a number that is equal to cost.

- Contr Markup: using

a billing code with a type of Contr Markup

will calculate the cost of all billing codes with a type of Contract

that are listed above on the invoice times the percentage in the Rate field of the billing code. A

prompt will appear on the Sales Invoicing screen when this type of billing

code is used, and the percentage in the Rate

field will appear as the default. It

may be changed to any percentage at that point. Before

using this type of billing code, the billing codes with a type of Contract must have a debit and credit

account number in the cost fields of the markup codes themselves. If

account numbers are entered into these two cost fields on the billing

code, the billing code will prompt the user for a cost per unit that will

be totaled in the Other Cost field

on the Sales Invoicing screen. A

markup code with a type of Other Markup

calculates only on the cost of a billing code that has a type of Other, and not the selling price. In

the same scenario as the Mat Markup

code above regarding a bid, the selling prices should be zeroed out on

those line items before using a billing code with a type of Other

Markup. In

this way, the customer will see only one selling price for the entire

bid rather than individual line item selling prices. When

entering a Rate on the Enter

Billing Codes screen, use a number like 120 to calculate a 20%

profit. 100

would calculate a number that is equal to cost. The

amount that is calculated by this type of billing code will appear on

the Sales Reports in the Contract

field.

- Agreement: the

charges for a billing code with a type of Agreement

will appear in the Serv Agr column

on Sales Reports. Codes with this type will also be subject to tax codes with the Tax SA column checked.

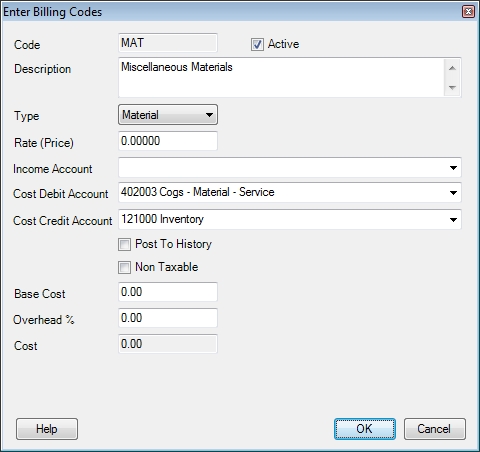

Rate (Price)

An amount may be set here.

When the

Billing Code is used on the Sales Invoicing screen, this amount will be

displayed each time this Billing Code is used. This

amount may be overridden when creating an invoice. This

Rate field may also be left blank

on the Billing Code, which will result in a blank price on the Sales Invoicing

screen. Any

amount may then be entered on the invoice.

Example: if you create

a labor Billing Code with a type of Labor

and a Rate of $70.00, using the

Billing Code on a sales invoice will set the Price to be $70.00 regardless of the rate tied to the customer's location. This

price may be edited, but the advantage of setting an amount in the Rate field of a billing code is to eliminate

the repetitive task of typing the same amount for many invoices for many

customers.

The Rate

field on a DISC (discount) Billing

Code will use that amount on a prompt for a discount percentage when entering

an invoice.

The Rate

field on a Mat Markup, Other

Markup or Contract Markup

billing code will be used to calculate the Price

based on cost times the Rate.

Income Account

When a sales invoice is

entered, the normal accounting flow is to credit some sort of sales income

account and debit accounts receivable. If

this field is left blank the income account will be determined by the

sales department used on the invoice. To

set this billing code to always use a fixed income account, enter the

account number in this field.

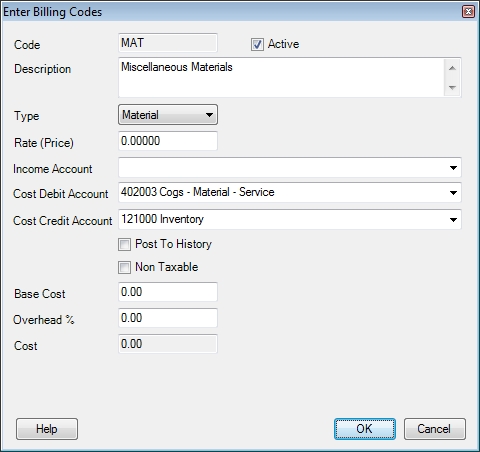

Cost Debit / Credit

When an inventory part

is billed on an invoice, the cost debit and credit is determined by the

accounts that are set up when that inventory part is entered. A

Billing Code does not have any cost defaults, so if you want to track the cost of the billing code - those accounts must be specified here. When using these fields you must enter both a debit and credit or your settings will be ignored.

Note: Costs associated with Labor type billing codes will only appear on quotes. True labor cost can only come from payroll, but you can add technicians to invoices or credit memos to have estimated labor costs appear on your sales reports.

Post to History

If this is checked "Yes", then when this Billing Code

is used, it will send a record to this customer’s Service History file.

The description

of the Billing Code will be the Service History description, and the name

of the code will appear in the Reference

field of Service History.

Non-Taxable

If this is checked, the

amount that is generated by this Billing Code on the invoice will not

taxed according to the Tax Code

associated with the customer's location.

Base Cost

This field is only used if you have added cost debit and credit accounts to the billing code. Use it to set the cost amount for the billing code or leave it blank to prompt the user for an amount when the code is used on an invoice, credit memo or quote.

Overhead

If a percentage is entered

in the Overhead field, the Base Cost will be multiplied by this

percentage to give a total cost. This

total cost is the amount that will be displayed in the lower left hand

corner cost field on the Sales Invoicing screen, and it will also be the

amount that is debited and credited for cost on the General Journal.

If the Base Cost was left blank, this field will be ignored - even if you enter costs in directly on the invoice when the code is used.

The following Billing

Codes have special abilities:

Labor

Leave

the rate field blank to have the selected customer’s default Labor

Rate used as the Price

when this Billing Code is added to an invoice. Please

note that using a labor Billing Code will not change the labor cost of

the invoice.

Tip: You can have more than one labor code. So if you do different types of work you can have one with a price of zero, which will pull the customer's default labor rate, and another with a price of $125.00 to cover a different type of work you perform.

Discount

When a discount Billing

Code is added to an invoice, the discount is only applied to entries shown

above it on the invoice.

Leave the rate field blank

to have the selected customer’s default Discount

Percentage used as the discount when this Billing Code is added

to an invoice.

Leave the description

field blank to have the discount amount displayed on the invoice as "xx% Discount." This

is helpful when the discount may be variable.

Helper

Leave the rate field blank

to have the selected customer’s default Helper

Rate used as the Unit Price

when this Billing Code is added to an invoice. Please note that using

a helper Billing Code will not change the labor cost of the invoice.

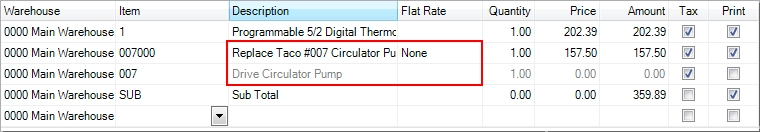

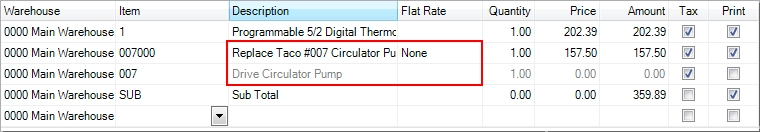

Sub

When a SUB

billing code is entered on the Sales Invoicing screen, a sub-total line

item will be created that will display a total of all line items that

appear above it. For

example, if you wish to enter a number of lines of inventory items, and

if you wish to show a sub-total of that material before the labor is added,

use SUB to add the inventory items.

Additional

lines may then be entered below the SUB

line, such as additional charges or fees.

Printing Your Billing Codes

Click the Print button to print out a complete list of all Billing Codes. The list can be printed with or without bar codes.

Related Topics

Related Topics